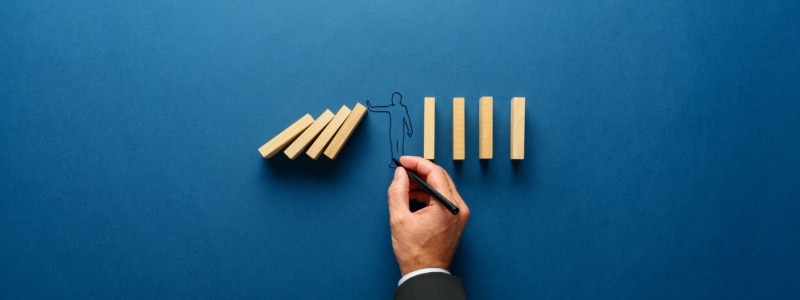

We know that all businesses face some degree of risk. Even the most cautious or financially prudent organisations can’t anticipate every challenge – just look at the coronavirus pandemic – and with everything from cyberattacks to supply chain disruptions, the spectrum of potential threats is broad.

But effective risk management can protect organisations from both the anticipated and the unanticipated threats. Effective risk mitigation not only safeguards a company’s assets and reputation but can also enhance its decision-making processes and its strategic positioning. In short, any business focused on stability and profitability will seek to manage – and mitigate – the risks and challenges that can affect its operations and bottom line.

What are business operations?

Business operations is the term used to encompass all of the day-to-day business activities that generate value or earn revenue for an organisation.

These activities can include everything from production and manufacturing to project management and customer services. Essentially, business operations are the engine of the organisation. Without this engine, there’s nothing to drive a business strategy forward. There’s nothing to make, or produce, or sell. There’s no income or profit. Without business operations, there is effectively no business to speak of.

Identifying risks in business operations

Identifying potential risks within an organisation’s business operations is the first step in a comprehensive risk management process – and it’s absolutely essential for the smooth running of business operations more generally.

Common risk events include:

- Financial risks

- Operational risks

- Strategic risks

- Reputational risks.

This process typically involves recognising possible risks that could negatively affect the company’s ability to function effectively, and it requires extensive research, analysis, and collaboration with business leaders as well as with stakeholders in every area of the organisation. This information can then be collated into some kind of template or dashboard that facilitates risk monitoring and tracking risks in real-time.

It’s a time-consuming task, but by conducting a thorough risk identification and assessment, businesses can better understand the potential impact of different risks, and then prioritise which ones to address based on both the likelihood and the impact of the risk.

What is operational risk management?

Operational risk management is a methodology that’s used to identify, assess, and prepare for any potential risks that could interfere with a company’s operations and objectives. For example, this can include the risk of loss resulting from inadequate or failed internal processes, people, systems, or from external events such as natural disasters or cyberattacks.

Operational risk management aims to minimise the potential impact of these types of risks while protecting business continuity, and it’s growing in importance every day:

“In the not-so-distant past, especially before the financial crisis of 2008/09, many companies approached operational-risk measures from a regulatory perspective, with an economy of effort, if not formalistically. Incurring costs and paying fines for unforeseen breaches and events were accordingly counted as the cost of doing business,” McKinsey explains in a 2023 article. “The present environment, however, is unforgiving of such approaches. An accelerated pace of change, especially in digitisation and social media, magnifies the negative effects of missteps in the aftermath of crisis events. Leaders are consequently grappling with the long-term effects of operational-risk events, seeking crucially to avoid the dangers of underestimating their impact on market value.”

Operational risk management best practice: steps and strategies

Adopting best practices in operational risk management involves several key steps and strategies. As we know, risk identification is an essential first step: organisations need to know what could go wrong, and where their vulnerabilities in business operations sit.

After that comes risk assessment, which is where identified risks are analysed in order to determine their potential severity as well as the likelihood of the risk occurring. This is typically followed by risk mitigation planning. During this planning, organisations will develop risk mitigation strategies to help them manage – or even eliminate – potential risks. Options essentially include risk transfer, risk avoidance, or risk acceptance.

The risk management strategy will then be implemented through a series of policies, procedures, and control systems. And after that, it should be tracked. The business needs to be continuously monitoring risks and reviewing risk levels – and the effectiveness of mitigation measures – so that it can adjust the strategy to address new or changing challenges.

Different ways to mitigate risk in business operations

There are a variety of ways that a business can address risks, and these can be adapted and tailored to suit the specific needs – and vulnerabilities – of the organisation. For example, some organisations may focus their efforts on overall risk reduction, while others that have a greater appetite for risk may focus more on assessing risks and mitigating only those that are found to be the most high-risk.

Some methods for risk mitigation include:

Risk mitigation plans

A risk mitigation plan outlines specific strategies for dealing with an organisation’s identified risks. For example, this plan might include measures such as:

- Employee training to enhance skills and awareness around particular risks

- Implementing advanced cybersecurity measures to protect against data breaches

- Using automation to improve accuracy and efficiency in critical processes.

With a risk management plan in place, organisations are better prepared to respond quickly and effectively to risks if they should happen to arise.

Business continuity plans

Business continuity plans (BCPs) are developed to ensure an organisation can maintain its business functions – or quickly resume them – even when faced with a major disruption. This disruption could be anything from a natural disaster to a significant cyberattack or supply chain failure – a well-structured BCP will plan for them all, and make sure that critical business processes can continue during a crisis, minimising downtime as well as financial loss.

Contingency plans

Contingency plans are designed to be implemented when business risk events that cannot be mitigated happen. These plans often include backup systems, alternative resource allocations, and other emergency response actions. They are crucial for enabling businesses to quickly adapt and continue operations even under adverse conditions.

Develop a reputation for effective operations management

Shape your leadership and management skills to successfully navigate modern business environments – and risks – with the University of Sunderland’s 100% online MSc Management course. This flexible master’s course has been developed for working professionals worldwide and is delivered entirely online, so you can earn your master’s from anywhere, on mobile or desktop, and fit your studies around your work and family life.